When is advice not advice? That’s a question that has vexed regulators and advisers for years.

Financial planners fear straying into a compliance nightmare by just giving generic information to clients, while guidance providers feel they can’t help savers find the right deals nearly as much as they want to.

After years of trying to draw a firm line through this grey area, the FCA has announced a plan to solve it once and for all. It has spent several hundred thousand pounds on that work, we can reveal. The trouble is, according to responses to its consultation, we can also reveal most people seem to think its ideas are a bit Mickey Mouse.

The grand plan

In December, the FCA issued a set of three proposals to close the advice gap by reviewing the boundary between advice and guidance. Banks and others providers could be allowed to sell products to certain groups of customers without veering into advice through a new category of ‘targeted support’. Based on a series of questions, ‘people like you’ could have different ways of accessing their pension described to them, for example, or be told they might be holding too much cash.

For small sums and simple needs, personal recommendations could fall under a new ‘simplified advice’ regime. A threshold of less than £10,000 is needed to quality.

The regulator is also proposing issuing further information on exactly where support or guidance can start to look like advice to investors. That paper alone cost £373,464 to put together, according to a Freedom of Information Act request. It doesn’t seem to have gone down too well, however.

“These proposals are the equivalent of the FCA smelling their own farts out of a wine glass,” says one frequent visitor to the regulator. “It’s a needless over complication.”

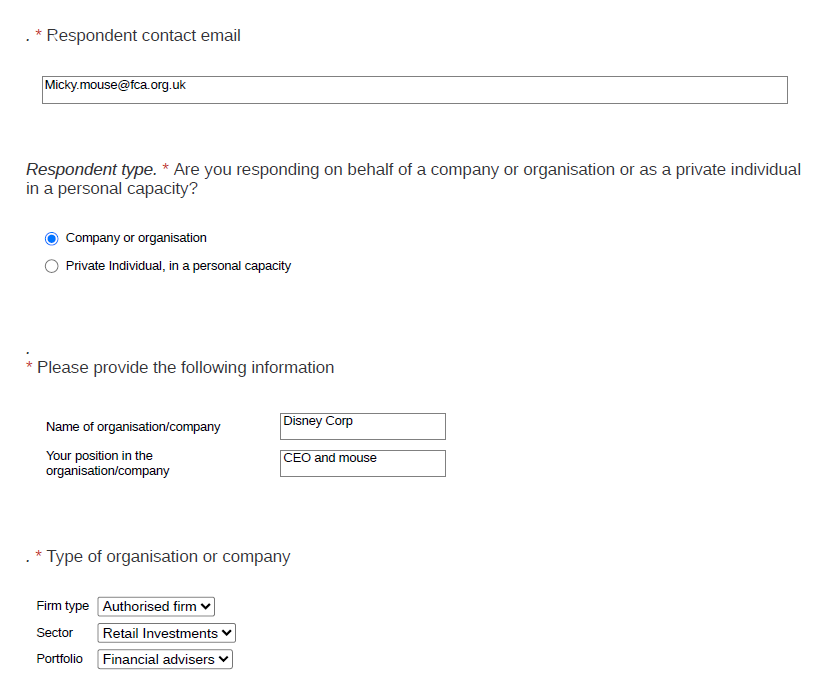

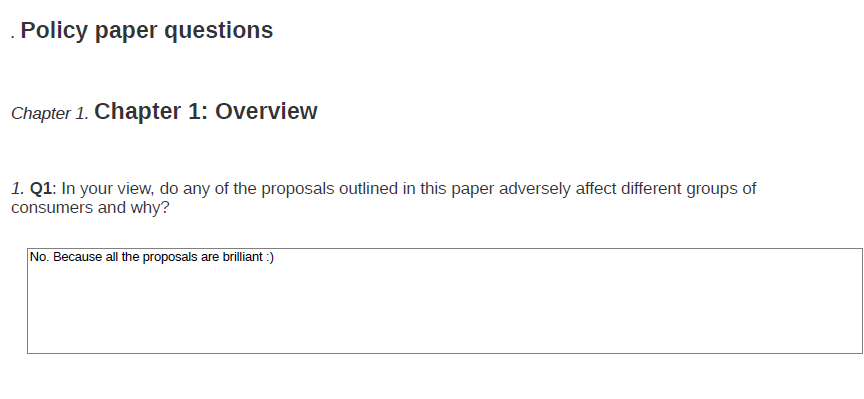

The consultation closes on 28 February. The FCA was able to provide a copy of only one piece of feedback marked non-confidential by the respondent. They gave their name as Mickey Mouse, CEO and mouse at Disney Corp.

When asked if any of the proposals outlined in the paper adversely affect different groups of consumers, Mickey Mouse replied: “No, because all the proposals are brilliant 🙂 ”.

They left every other box blank.

A brick wall

The regulator said it was “expecting to receive more responses nearer to the feedback end period”.

But the paper marks just the latest in a long line of similar efforts to solve the advice-guidance boundary. The simplified advice regime, for instance, rekindles previously dropped plans to introduce such a category.

The FCA said it was not able to work out how much it had spent on previous consultations on similar topics – for example the Financial Advice Market Review and a separate paper on how to streamline advice on simple products like stocks and shares ISAs – because there wasn’t a fixed number of staff that worked on them.

“Quite frankly, I lost the will to live half way through,” one advice market veteran says of the proposals. “The blob just rolls on regardless.”

Meeting in the middle

The FCA has held at least 13 meetings with industry about the reforms, it disclosed in response to our Freedom of Information Act request. These include engagements with trade bodies like the Association of British Insurers, the Pensions and Lifetime Savings Association and TISA, as well as other regulatory and government agencies like the Financial Services Compensation Scheme, Financial Ombudsman Service and Treasury.

Consumer-facing groups including Which? and the Money and Pension Service also got a seat at the table with the regulator.

After all of that effort, what might we accomplish by the end of proceedings? The size of the pie is potentially huge. There are around 5,100 retail investment firms in the UK, per FCA figures. In 2022, 4.4 million people got advice, less than half the 9.7 million UK consumers the regulator says have over £10,000 in investable assets but are mostly – or entirely – sitting in cash.

That is despite 4.2 million of those having at least some appetite for investment risk.

Ask for estimates of the number of financial advisers and customers that could use the new forms of simplified advice and targeted support, the FCA said it was “still at the initial stage of the review” so could not provide figures. It also declined to provide minutes of its meetings with industry, arguing it would get in the way of its ability to regulate the market.

“The whole thing makes me chuckle,” says a compliance consultant in the space.

Photo by on Brian McGowan Unsplash